- Politics

- Diversity, equity and inclusion

- Financial Decision Making

- Telehealth

- Patient Experience

- Leadership

- Point of Care Tools

- Product Solutions

- Management

- Technology

- Healthcare Transformation

- Data + Technology

- Safer Hospitals

- Business

- Providers in Practice

- Mergers and Acquisitions

- AI & Data Analytics

- Cybersecurity

- Interoperability & EHRs

- Medical Devices

- Pop Health Tech

- Precision Medicine

- Virtual Care

- Health equity

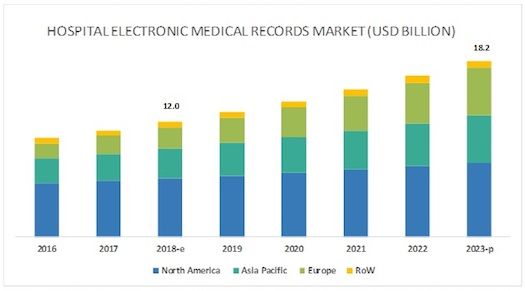

Global Hospital EMR Systems Market: Key Growth Drivers

What’s next for electronic medical records and health tech?

Electronic medical records (EMRs) comprise a record of the patient’s medical history, diagnoses and treatment, medications, allergies and immunizations, as well as radiology images and laboratory results. But how are the markets for these game-changing technologies growing across the world?

>> LISTEN: The Slow, Frustrating Rise of the Electronic Health Record

Over the years, EMR solutions emerged as powerful tools to curtail rising healthcare costs while improving overall healthcare quality. EMR systems have significantly minimized the use of paper and increased the operational efficiency of healthcare organizations while adhering to applicable laws. EMRs brought a significant change in providing healthcare, reducing errors and increasing impact for patients. These factors, in turn, have advanced EMR adoption. Federal mandates and favorable government initiatives also drove the rapid adoption of EMR systems. The HITECH Act, for instance, has placed new requirements on healthcare organizations in terms of Meaningful Use criteria, which drove reimbursements (financial incentives) for the meaningful use of certified EMR technology. With such federal mandates governing the implementation of EMR, the adoption of EMR has increased to more than 95 percent.

The EMR has come a long way in terms of technology, however, interoperability and data privacy still major concerns. Heterogeneity in health information systems is one of the key challenges for the successful implementation and utilization of EMR solutions. Many countries lack specific IT standards for data storage and exchange, which lead to interoperability issues. Although various data storage, transportation and safety standards are in place, the implementation of these interoperability standards has been a challenge for healthcare providers and EMR vendors. The U.S. Department of Health and Human Services has committed to promoting and prioritizing interoperability of healthcare data. The Centers for Medicare & Medicaid Services, for example, renamed the EHR Incentive Programs to the Promoting Interoperability Programs in April 2018, a change that’s expected to move the programs beyond the existing requirements of meaningful use to a new phase of EMR measurement with an increased focus on interoperability and improving patient access to health information.

The increasing adoption of EMRs has resulted in increasing data collection, which in turn is enabling healthcare providers to use this information to improve the health of the entire population. Deploying various analytical tools on this information is helping clinicians identify specific patterns in populations suffering from a particular disease and make better clinical decisions, thus helping improving care in the entire population. The analytical tools are also helping in predicting risk for hospitalizations or readmissions. Further technological advancements such as mobile applications, voice recognition and artificial intelligence (AI) are expected to immensely improve care while improving the ease of use of the technology.

Mobile EMR is emerging as a major growth area in the hospital EMR systems market and has been shown to improve the efficiency of healthcare providers. In hospitals, accessing an EMR through a tablet or phone is shown to improve the efficiency of inpatient medical care by facilitating earlier order entry and decreasing inpatient data management time. Mobile devices can also improve documentation and medical decision-making. Major EMR vendors are focusing on enhancing the adoption of mobile technology by healthcare providers.

Other major areas of focus in the hospital EMR systems market include Smart EMRs using AI and voice recognition technology. Some of the key developments taking place in the smart EMR market are:

- Google is exploring ways to use AI and voice recognition to improve patients’ visits to the doctor. Google is working on a project called Medical Brain, which would likely take advantage of the complex voice technologies Google already uses in its Home, Assistant and Translate products.

- Stanford Medicine and Google Research announced a pilot project to study the use of a digital scribe to replace a human scribe, which could save physicians time on data entry and improve physician-patient interactions. The digital-scribe system uses speech recognition technology and machine learning tools to automatically enter information into an EMR system.

- Microsoft is collaborating with the University of Pittsburgh Medical Center (UPMC) on its Intelligent Scribe platform, which is a virtual AI assistant that “listens in” during a doctor’s visit and takes notes. The application analyzes a doctor’s conversation with a patient and then makes suggestions in the patient’s electronic health record.

The growing hospital EMR systems market is attracting traction from tech giants such as Apple, Google and Amazon. The companies have launched their products in 2018 and are coming up with various strategies to claim a share in the EMR market.

- In January 2018, Apple launched its Health Records EMR data viewer. Early participants, including Cedars Sinai, Cerner Healthe Clinic, Dignity Health and other large health systems, began allowing patients to access and view their complete EMRs on iOS devices. The EMR data viewer will likely have an immediate and significant positive impact on patient engagement, health IT innovation and interoperability.

- In June 2018, Apple announced a new Health Records application programming interface (API) that will allow health IT innovators and researchers to create apps that leverage EMR data to improve medication management, nutrition plan development, disease diagnosis and other clinical processes.

- Google is helping to drive innovation through its open-source Google Cloud Healthcare API, which is designed to overcome interoperability challenges by providing an infrastructure solution based on Fast Healthcare Interoperability Resources (FHIR).

- Amazon Web Services (AWS) took the first step in the EMR industry by partnering with Medsphere. In March 2018, Medsphere moved its CareVue EMR system offering to AWS to ease the financial strain of EMR implementation for community hospitals by eliminating the need for local data centers. CareVue Cloud is a platform-as-a-service (PaaS) option that will allow users cost savings and professional data security.

With the rising entrants into the hospital EMR systems market, EMR vendors are employing various strategies to sustain in the market. The major strategies employed by EMR vendors include expanding their customer base, diversifying product portfolios, acquisitions, geographic expansions, agreements, collaborations and partnerships amongst others.

Swapnil Shitole is a corporate communicator for Markets and Markets. To read the research firm’s report on the EMR market, click here.

Get the best insights in healthcare analytics directly to your inbox.

Related

Doctors Aren’t Luddites. But Their EHRs Are Broken

Alexa for Doctors Claims 70 Percent Reduction in EHR Time